A Glimpse Behind the Curtain: ViewRay

A Twenty One Pilots song comes to mind: "Stay in your lane boy... lane boy"

Business Wednesday Edition:

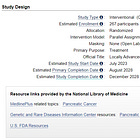

This past week (July 17th, 2023) ViewRay, the maker of MRI linacs declared bankruptcy. And, I’ve kind of been down that path, well, from the side of, “let’s try to put this thing back together.” Following the announcement, I flashed back just a few years to the acquisition of the proton center in OKC via federal bankruptcy. And so today, we’ll take a peek beyond the curtain.

I want to be clear, I’m no attorney - this is a bankruptcy of a publicly traded company - a process which I have never been involved in, but today we’ll just cover some basics of the process and where to find credible (hehe) information. Perhaps providing some insight and show those who are interested, how to follow along. And hopefully emphasize the complexity of the process.

First things first. I really like the ViewRay product. Clinically I think it appears to be a fantastic use tool. (never used it but very familiar) - I’ve literally referred patients from a proton center to an MRI linac - how many can say that. Heck, I even wrote the article below praising the company for its work in our space.

Instead of that type of approach, we need strong trial design with clear answers that impact change. And alongside of that initiative, we need to develop better methods in our healthcare system to utilize and share the highest cost capital equipment more efficiently.

Based on what I see today, I say “Kudos!” to the teams and leaders of these two trials and to ViewRay for the support to push for better with a technology trials for our field and our patients.

But I would say this - if you sit on purchasing committees or even make recommendations to your organizations - this event is real and represents change in the market. Talk to business people about the impacts of this event - and disregard what you see on Twitter. Much of the purpose here today is to help those that might read physician social posts to help create their opinion and at least here - on this topic, I say pause. At times, physicians might be wise to “stay in your lane boy… lane boy” - here I suggest speaking with business people experienced in bankruptcy, private equity players and of course, legal experts on the topic.

As I’ve been told:

“If you seen one bankruptcy, you have seen one bankruptcy.”

Each unique and nuanced.

And with an ironic twist, I now peek around the curtain that I just said we shouldn’t touch.

A Small Glimpse Behind the Curtain:

DIP financing - been there. Federal bankruptcy in Delaware - done that. Granted I didn’t wire funds but was well within arms reach and close enough to make the palms sweat. While you won’t find my name anywhere in the court docket, I sat at the meetings as the lone physician and helped describe the opportunity I saw for protons and for the facility as we raised the monies to hopefully acquire the facility. A front row seat.

With a publicly traded company? - no. So certainly different and likely a different scale, but in the last week or so I went down memory lane a bit and decided to give some context - appreciating that I might be leaning on the next words in the song to much: “but we go where we want to”.

What Appears to have happened.

It is quite rare that I run into people that I consider to simply have significantly more general radiation business context than I have. I’ve been blessed to do quite a bit on the business side over two decades and few physicians take interest in that path.

Fortunately the next ASTRO President - Sameer Keole is one of them. Honestly, amazing context of our fields history and across many business aspects, he has great insight. To me, he consistently brings great big picture context paired with details in our conversations. Here is one of his tweets on the early days of ViewRay.

IMO: Huge cash burn and delays Series A closed Dec 2005.

Original plan: MR cobalt by 2008-09. This was delayed 5 years.

Pivot to MR Linac was the right decision but added 3 years.

77387 didn’t help. Again, had to pivot.

He remembers the early times and some of the twists and turns that were required.

Me? My summary focuses later: despite clear hurdles, over the years, they built a great product - they had initial capital and navigated a startup to have 62 facilities installed worldwide with 28 in the US alone. Impressive work. Heck, I think they have demonstrated benefit of the technology - some debate the evidence (margin vs. technology), but its arguably as good as proton data and something I’m not aware of Cyberknife showing - so they deserve real kudos for that accomplishment!

They were able to have an IPO and had a market cap well in excess of 1.2 billion dollars at one point. And somewhere in the curve, well specifically from December of 2019 to January of 2021, Elekta owned about 7.3% of the company. With quite excellent timing, they exited that $53M position making $17.5M on that “trade” while gaining insight.

In contrast, today any residual equity value is simply gone. Market capitalization of the company is shown below - today expected to open at less than $0.03 / share with market cap in that stock under $5M. Ouch!

But back to the story of where we are today. Things proceed until later in November of 2022 when MidCap Financial was brought into the picture to, at least on some level, come in and help figure out the path forward. Here is the “ad” on their site advertising the initial relationship with ViewRay.

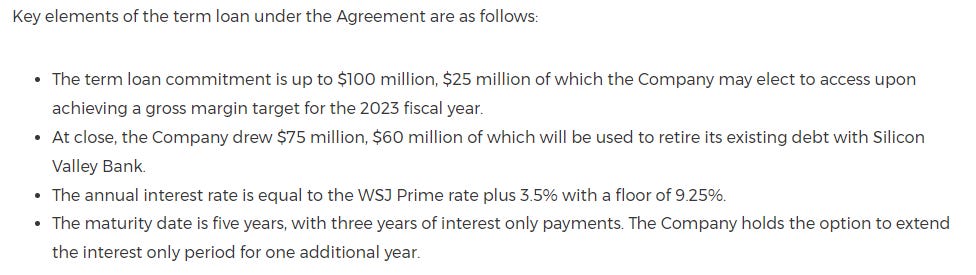

And below was one of their first actions - secure $100M in debt (plus revolving credit line) to re-capitalize the business.

Note the terms in this public announcement:

Just to give you an idea - the WSJ Prime Rate is currently 8.25% so this is at least 11.5% money at this point. Even prior to interest increases, the FLOOR on the money was 9.25%.

While it might have appeared stable on the outside, obviously they needed money. Needed it bad, and they were willing to pay over 10% for it. That was November of 2022. For anyone looking, the writing was on the wall. Big changes were coming. And 9 months later, we have the Chapter 11 filing.

If you are interested in reading more than you ever want - go here:

https://cases.stretto.com/ViewRay

(then click on Search Court Docket)

And yes, the legal documentation will roll like this - pages upon pages - if I recall correctly, 100k in attorneys fees initially lasted maybe a few weeks - maybe. These are big projects - not for the faint of heart. You are swimming in the deep end of the pool - at least from the perspective of a radiation oncologist.

Now my guesses: Perhaps where I should not go.

I’d assume MidCap tried to tweak things during that time - clean things up and find a buyer in this 9 month period - this is when, I think, it is most likely that Siemens or other large players would have considered a purchase. And in fact, this is what the documentation shows - well maybe - you decide. Here are some highlights from the General Background from one of the motions - as I said earlier - everything will be public information - just a matter of digging and how deep you decide to go. And basically before anyone was able to or willing to put a deal down on paper, the money ran out.

As described in the First Day Declaration, since their inception, the Debtors have had negative cash flows from operations and have incurred significant net operating losses. Until the Petition Date, the Debtors have funded their operations principally through use of secured loans, offerings of capital stock, issuances of warrants, issuances of convertible promissory notes, customer deposits for new orders, and payments from customers for MRIdian systems installed and delivered.

Specifically, the Debtors engaged Berkeley Research Group (“BRG”) as financial advisor to evaluate options for and guide any potential restructuring, and Bank of America (“BofA”) to explore options and identify a potential strategic partner for a refinancing transaction (while Goldman Sachs continued to pursue a sale transaction). BofA contacted over forty-five potential strategic and financial investors and brought over thirty entities “over the wall” to explore a potential financing transaction.

Unfortunately, the Debtors did not receive a letter of intent within the time required under the First Amendment to the Standstill Agreement and they lacked additional runway to continue pursuit of an out-of-court strategic transaction. In view of the circumstances, the Debtors, in consultation with the Prepetition Secured Parties, determined that an in-court restructuring or sale process provided the last, best chance to preserve the value of the Business and the Assets for the benefit of all stakeholders.

As of today, twenty-six (26) potential buyers have entered into confidentiality agreements, and B. Riley is diligently pursuing obtaining confidentiality agreements from two (2) additional potential buyers. Fourteen (14) parties are actively reviewing the documents in B. Riley’s data room, and B. Riley has engaged in one-on-one calls with twelve (12) parties. Further, B. Riley is tracking and continuing communications with parties that have declined to act as the buyer in a sale transaction but that have indicated they may be willing to finance a sale transaction with another party.

Fortunately there are multiple parties interested in the purchase. That is a good sign from my perspective.

Here are the assets of the company:

The Debtors’ Assets include, among other things, intellectual property, inventory, property and equipment, cash and cash equivalents, accounts receivable, and deposits on purchased inventory. The Debtors’ intellectual property includes a patent portfolio comprising an exclusive license to five issued U.S. patents, four issued foreign patents, and one pending U.S. application as of February 1, 2023. The Debtors also own an additional forty-three issued U.S. patents, 122 issued foreign patents (seventy of which were issued in Great Britain, Germany, France, Italy, and the Netherlands as a result of fourteen patent applications filed and allowed through the European Patent Office), nineteen pending U.S. applications, and forty-five pending foreign applications as of February 1, 2023.

And below are some deadlines:

Bid Deadline. Each bid must be transmitted by email (in PDF and Word) so as to be actually received on or before September 11, 2023, at 5:00 p.m. (ET),

The company stock trades today at around $0.02 with 62 machines installed. Clearly the stock today is deemed as valueless. My read of day one pleadings point to a Section 363 sale which in effect means very likely the shareholder will see no return of capital. My simple summary: not enough residual value available to make any significant payment back to stock shareholders - and this is consistent with what you see in the market.

It will be interesting to return in September and take a look at the actual bids. I do think they will give insight into the perceived value of the company. And it will be interesting to see if it is final player or an intermediary. I think we’ll see the names of the players, but they very well could be bundled into LLCs or other entities to hide / protect interests. My guess is it is likely to be a private equity intermediary but time will tell.

As to the value, I think the sale structure likely means it won’t be too high either. If it sold for a lot of money, stock holders might then see some return of capital and that doesn’t appear to be priced in. You don’t get to use bankruptcy to just clear the deck without real issues and real penalties. At least that is my simplified view of the process. This article put the liabilities at $178M as of April. My guess would be bids start rolling in at a fraction of this amount, but time will tell - the central point of restructuring is to remove the vast majority of these liabilities.

Debtor-in-possession (DIP) financing is via MidCap Financial Services which is actually the group that was called in last year to help stabilize the company and helped to coordinate the 100M debt. The $6M DIP financing is basically “working capital” to help keep the lights on during the filing and bankruptcy process. (One difference between Chapter 11 and Chapter 7). But for scope, according to this article, cash burn for the preceding quarter might be pushing ~60M (earlier other reports put that number closer to $40M per quarter) and annual losses have exceeded 100M per year - so at least $25M per quarter. MidCap Financial’s involvement in providing DIP financing reiterates their position as one of the primary players in the deal - clearly at the table putting money in - whether it is them or they are working on behalf of others, I’m less clear.

But if you burn through even 40M in a quarter, $6M won’t carry you too far. Now in this case, they still have revenue - the money from the service contracts will continue to roll in. I have solid estimates that I’ll keep private but if you have a machine or a contact, ask them. And then multiply that number times 62. Not individually cheap but not enough in total to float the boat either. So the $6M supplements the service contract revenue making simple burn rate calculations more difficult especially after massive layoffs and other cost-cutting measures that have been undertaken.

But regardless, the clock ticks forward each day. Even cutting cash burn to $12M from $25M-$40M per quarter still likely results in answers of months to see this settled even considering significant service revenue. Maybe that is just the first tranche of DIP financing - I didn’t go look - but again, public records will show the path and it seems consistent with the timeline in our venture.

Upon a Successful Bid and Purchase:

If / when the deal closes, it represents at least the 4th round of capital for this project. Remember: 1) startup funding, 2) public IPO, 3) November 100M loan, and this will be at least four (I likely missed some because really I didn’t go looking). The goal of the likely purchaser being stabilize - show profits via fundamental changes to the business and hopefully regain a large portion of the lost market cap - buy a plane and retire :) Whether this is done via MidCap or via a different private equity group post purchase, I’m not sure matters.

Could a large company swoop in via bidding or via majority funding of one of these equity players and keep things rolling without a hitch - yes - I guess. But wow - at even $50M per year (half the losses), that would be expensive quickly unless you can solve the money puzzle that to date, hasn’t been solved. So my guess is the more likely scenario is for the first party to try and clean up the balance sheet via large scale debt reduction, do the tough work and then try to wind up the value for the risk they took. And THEN off load the restructured company to a larger entity, assuming they can fix the model.

In the end, I think this all plays out over a year or two or four - not weeks or months. I wonder if contracts don’t have to all be re-structured for all the service items - likely not going down in price. Any explosive growth models will be removed as purchasers (new potential users) will be more cautious. Restructuring of all the service contracts - with the massive healthcare entities that purchase these products will take time - lots of it. And in the interim there is some risk of struggles with those service contracts (has to be). As a clinician I honestly hope for none or minor but somewhere there will likely be pain beyond just the employees and capital investors.

I remain hopeful this turns out well for the owners of the machines and new acquiring entities and for our field in the long run - I do think the machine itself is a real add to our field and to our patients. But I would not dismiss the impact this might potentially have.

Why write on such a financial topic that is really, on some level, beyond my reach?

Well, I’ve been closer than most and there was, in my assessment, some pretty simplistic and naïve views being shared online via people quite high in the marketplace. And for that reason, I started to write regarding the complexity and uncertainty that I think exists - and I like here better than other outlets. Read the docket if you need a refresher of the complexity. Hopefully I’m wrong and the dust settles quickly without any interruptions. As a clinician who likes the technology, that is my hope. But businesses don’t survive on hope.

Secondly, it is good for those who might look at our workforce issues or ROCR to see that our field is truly beginning to see real impact of financial pressures. The days of “free money” floating around radiation are gone (my assessment). Watching this process evolve will give some insight into just how the largest players in our field value a technology driven future. Emotions will be removed. This will be a dollar and cents - risks and benefits - forecasting and predictions - spreadsheet calculations. And then fudged with a big guess estimation. And for those reasons, it is worth watching.

*Turns and looks for the road*. “I need to get back in my lane.”

As always, author of one - everything here is simply public information along with scattered basic info from my own personal experience. If you see something that needs to be corrected or improved, please comment - happy to address and clarify. A rather sad topic for me personally but important to our small little segment of medicine.

Next up, a look at AI entering the prostate cancer space - I think likely angling to be a Decipher alternative. And yes, a ROCR piece is on the way, but this piece helps to build appropriate context and therefore was needed first - at least to me.

As always, thanks for following along on the journey for better.

Great article Mark, thank you! Their investment banker is saying the parties looking are primarily strategic and there are 6 participants (incl. Europe and Asia). Key disclosure on page 4 at https://cases.stretto.com/public/X258/12332/PLEADINGS/1233208182380000000118.pdf

Does that change your outlook for the viability of this? They are burning through money but at the same time in April they had $226 million in assets versus $178 million liabilities so at least as of April there was positive book value. Assets were mostly cash, customer receivables, and inventory, and zero value ascribed to any of the patents (intangible assets valued at $37 thousand). Interesting situation and would love any updated thoughts now that it's been a month.

The "free money" days are gone! In this environment, vendors will need to emphasize higher clinical benefit at a lower cost. Great article.